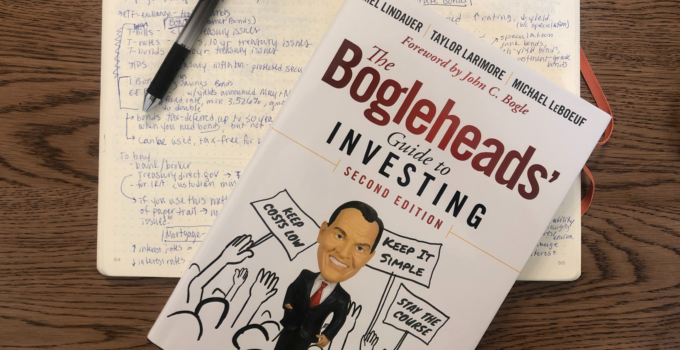

Learning how to invest can be overwhelming. And honestly, I’ve put together a beginner’s guide to investing, but I must confess: I’m still a beginner. I mean, I know what I’m doing in theory: max out tax-advantaged accounts, invest in index funds, don’t move things around too much. But I picked up The Bogleheads’ Guide to Investing, by Lindauer, Larimore, and LeBoeuf, to learn how to build my own investing strategy and to feel more in control of what I’m doing.

I picked this book to guide me because it’s one of the top recommended books on r/financialindependence for investing. And, though I haven’t applied the strategies suggested in the book, I definitely feel like it’s anchored me on what to do next. I’ll do a quick review of what’s contained in this book and my three personal takeaways, just in case you’re wondering if you should read this.

What’s Inside The Bogleheads’ Guide to Investing

This book is based off the wisdom of John C. Bogle who founded The Vanguard Group and created the first index fund. This guy is the granddaddy of set-it-and-forget-it investing, which oh so many economic studies support. People who follow his investment philosophy call themselves Bogleheads. The philosophy has three parts: (1) keep costs low; (2) keep it simple; (3) stay the course.

This book is laid out in two parts. The first is a LOT of definitions. In fact, I thought it was so clear and well-laid-out that I bought a copy so that I could flip through it over time. The second part contains strategies for how to keep you on track to your financial goals.

Part 1: Essentials of Successful Investing

Like I said, this part is a lot of definitions. If you ever wondered about the nuances between different kinds of mutual funds, this is the section for you. I will admit that, after taking a ton of detailed notes on the first few sections, I started skimming this section. And I would recommend that for anyone approaching this book. Start by whizzing through this part and getting a vague idea of what information is in which chapters. Then, when you have a question or need to reference something, you can go back and read in depth.

This section also includes a section on choosing your desired asset balance, the key to maintaining proper diversification in an investment portfolio. A word of warning: this book doesn’t tell you the correct asset balance to maintain. Instead, it lays out how you should think about choosing your asset balance.

Part 2: Follow-Through Strategies to Keep You On Target

This is the meat of the book. You could easily find the information in Part 1 online or in any other investment introduction. But if you want to tap into the Boglehead philosophy ((1) keep costs low; (2) keep it simple; (3) stay the course), here’s where that’s all laid out.

The chapters walk through how and when to rebalance your portfolio, how to avoid common investment pitfalls, and a couple more topics that are tangentially related to long-term investing (insurance, leaving a legacy, etc).

Katherine’s Takeaways from The Bogleheads’ Guide to Investing

I’ll probably write more on this once I’ve implemented the strategies I’ve learned. At that point, I expect to have more opinions. But here are the three ways my mindset has shifted, thanks to this book.

Don’t Overthink Your Asset Allocation

This is the most valuable thing I took away from this book. After reading through, it became clear to me that there isn’t a right asset allocation. The percentage of your investments that sit in stocks vs. bonds depends on your risk tolerance. And that changes over time as your life circumstances change! My husband and I have been meaning to sit down and build a more concrete financial plan for ourselves, and this book is going to be my guidebook for making sure we’re making informed decisions with our investments.

One of the big reasons why I bought the book (I originally read it on my Kindle, checked out from the library) was for the quiz in the back. It has a Cosmo-style quiz to determine your risk profile and suggest an asset allocation. I’m going to have my husband take it separate from me, to use as a starting point for our discussion about how to set our asset allocation.

Taxes Are Costs

I’ve long absorbed and accepted the concept that, in order to increase your net worth, you can either increase your assets or reduce your liabilities. If you look at your personal balance sheet, that makes sense. In a similar way, the first part of a Bogleheads’ technique (keep costs low) can mean both to minimize the number of fees you’re paying on your investments and minimize the amount of taxes you pay on your investments.

Now, I’m not recommending tax fraud (to be clear). But I’ll be keeping an eye on the costs on my investments in two ways. (1) I’m going to be sure to hold any taxable investments for at least one year to pay long-term capital gains taxes instead of short-term capital gains taxes. (2) I’ll be keeping my tax-inefficient investments in my tax-sheltered accounts (401(k)s, IRAs) and my tax-efficient investments in my taxable accounts. This book has explanations for all this, so check it out if you want more info!

“Regular” Check-Ins for Investments Aren’t That Frequent

I am a HUGE believer in checking in on your goals on a regular basis. I personally do a goal progress check on a weekly basis and a goal prioritization check every month. For my finances, I check in on things every month. But I won’t be touching my investments that often. And that is a RELIEF.

From everything I’ve read in this book, it’s clear to me that messing with your investments every month is a quick way to erode your savings by incurring fees. It’s also a great way to accidentally fall into common investing traps. So instead, once we set our asset allocation, we’ll be checking in on an annual basis. Once per year, we’ll decide if we need to rebalance and do that. It will also be when we check on our insurance needs and update our long-term financial plan.

Summary

The Bogleheads’ Guide to Investing is a great, compact primer on investment strategy. Clocking in at a mere 270 pages (excluding appendices), it’s a quick way to find your feet when you start investing. I’m a huge learn-by-doer, and this is the kind of book that will benefit me and others like me. If you’re looking for a reference book for investing, there’s a reason this one comes highly recommended by people who know a LOT more than I do!