Hi, my name is Katherine, and I didn’t grow up in a house with perfect financial stability. I always had a roof over my head and food in my stomach, but the reality for my family was that our income varied over the years, and we had to adjust our budget accordingly. As a result, I deal with a not-insignificant amount of financial fear. And the more I talk to people about budgets, the more I learn how universal financial fear is.

What is financial fear?

Financial fear can mean different things depending on you and your circumstances. It could be the fear of not having enough money for retirement or a health crisis. You might fear that you’re doing the wrong things with your money. Or that the stock market will crash and you will lose everything. Or you could be afraid of even checking your bank account balance for fear of learning that you’re hopelessly terrible with money.

I will note that financial fear is different from financial insecurity. You are financially insecure if you don’t have enough money to cover your obligations. But you can have financial fear even if you have a healthy emergency fund and are actively saving for retirement. In fact, I suspect that some of the wealthier people in this world accumulate money out of financial fear (but that’s just me being an armchair psychiatrist).

And between you and me, I’ve struggled with financial fear for the past decade or so. The fear has driven a variety of behaviors, from compulsive spending and avoiding checking my bank account balance to gaining control of my finances and endlessly soapboxing about it to my loved ones (sorry, guys). And even though I’m in the best financial state of my life right now, I still struggle with anxiety about the future and whether I’ll have enough money to support myself and my family.

Why we have financial fear

I’ve thought a lot about financial fear, and I have some theories as to the origins of the fear.

We aren’t born with natural abilities to manage it

When we’re born, we don’t have an innate ability to do much, especially handle complex abstract concepts like money. But for most things in our lives, our parents and society around us provide us with models for behavior. We learn how to speak by imitating the sounds our parents make. Our personalities are shaped by our peers as much as they are our families. We internalize the examples around us in order to decide who we are and what we should do with our lives.

But money is a taboo. We don’t talk about money, how much we make, or what we do with it once we have it. Further, our society rewards those who appear to have accumulated large amounts of money. So society sends the message that money is something to seek out, but doesn’t provide a model for how to get it.

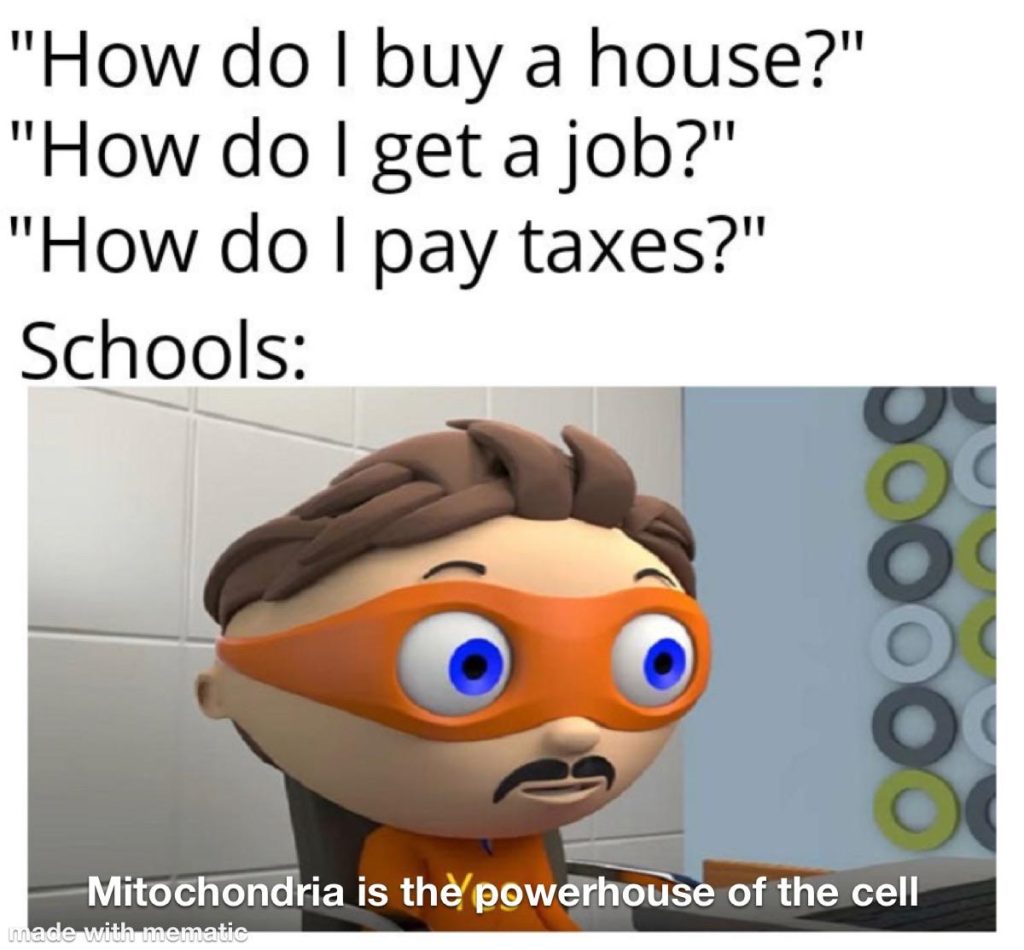

Some families or schools might have plans for teaching financial literacy, but it’s not as universal as, say:

There isn’t a universal way of dealing with finances

Even if financial literacy were a universally-taught subject in school…what would they teach? I would imagine an overview of how to open a bank account, how the stock market works, and some basic information about student loans and retirement savings.

But beyond that, there isn’t a universal way to deal with your money. Every person’s money situation is as unique as the person themselves! Your money is a tool to help you work toward your goals, but even two people with the same goals might choose different tactics to achieve them.

Fear of the unknown

Lacking a systematic way to learn about finances or even a standard blueprint to follow, financial fears are compounded by one additional factor: the unknown.

Simply put, a lot of financial fears are based in the fact that nobody knows what’s going to happen. The future is a big ol’ blob of who knows. And your brain is CREATIVE. It can come up with all sorts of scenarios and reasons to be freaked out. In your brain’s defense, it’s trying to prep you for any perceived threat, but it’s not always the most useful response, right?

And being freaked out about something often leads to people avoiding it (I know that’s what I do). And when you avoid a subject, it gives your brain more time to create even more anxious scenarios.

What can you do about your financial fear?

So understanding that financial fear is largely the fear of the unknown…what should we do next?

Acknowledge that it exists.

First and foremost, acknowledge the emotions you have. The fear or anxiety you’re feeling is totally normal, but you need to take the time to identify the emotion so that you can start taking steps to get yourself back to a state of calm.

Promise yourself to spend some mental resources on your finances.

Note that I specify mental resources. If you’re coming at your finances from a place of fear, you need to be patient with yourself and find ways to make it less scary. Perhaps break the process into the smallest possible step – check your bank balance. Or just log in!

If you’re in a place where you know what your finances look like, but you get overwhelmed with how to even start getting things in order, know that for most things, there’s not a perfect order to things. Picking something to work toward (build up an emergency fund, pay off one student loan, or learn what a mutual fund is) is better than letting the sheer possibilities overwhelm you.

And if you’re in a place where you have your finances in order but still deal with fear, take some time to identify what it is that scares you and see if there are steps you can take to mitigate whatever risk is haunting you.

No matter what the scenario, the important thing is to take time to work on it. Here’s an article from one of my favorite sites talking about how someone worked through their financial fears.

Keep that promise.

Unfortunately, conquering your financial fear isn’t going to be a one-day task. The best way to keep finances from leeching your mental energy is to have a regularly scheduled time to check in on them. One of my favorite sayings is, “The grass is greenest where you water it,” so if you think your financial garden is looking a little brown, you might need to get into a good routine of watering it!

Consistency is key. And be kind to yourself! Celebrate your wins (no matter how small), and always find a small step forward to take.

Talk about money with somebody.

Remember how I said that finances are a taboo subject these days? You know how to normalize a taboo subject? You talk about it!

I’m not saying you need to go tell your boss everything about your financial situation (unless you have that kind of relationship with your boss – I don’t know your life). But try and think of a friend or two who you would feel comfortable sharing your journey with. Tell them what you’re working on financially. Ask them how they’re feeling.

It’s an uncomfortable conversation, but you have the opportunity to bring camaraderie and compassion into your relationships. And who knows – you might be able to offer them some advice or insight they don’t have!