When it comes to personal finance, the goal is always to spend less and save more. But how do you go about figuring out what to spend LESS on? We live in a society that is constantly inundating us with messages about what to spend our money on. Even in the financial industry, the goal is to get you to give your money to somebody – and not for somebody to give you money. So how do you save for the right things?

The Ultimate Goal: YOUR Life

The hard thing about personal finances is that they are just that – personal. I can’t sit here and tell you what to save your money toward. The best thing I could get you to do is to sit down and think through what you want your life to look like. Think 10, 20, even 50 years into the future. What is your life? Are you working? Retired? Volunteering? Do you live in a city? In the woods? In a mythical treehouse city that gets you the best of urban living with a forested setting? (Um, if anybody wants to work on building such a city, I’d be down)

What do you do with your time? THIS is how you know that you’re saving for the right things. We only get one life, so you may as well figure out how to do what you want with it. And once you figure out what kind of life you want to finance, then you can start breaking that down into goals, with actual dollar values attached to them. Defining the goal is the hard part [LINK]. From there, it’s just shifting your savings to move toward that goal and waiting for it to happen.

As you work to define your life, you might find yourself questioning some of the things that you spend your money on. That’s a GOOD thing! It means that you’re evaluating your life according to your values. Try and figure out if you can shift that spending closer to your ideal life. That’s how you save for the right things.

How Do You Get There?

“Though no one can go back and make a brand new start, anyone can start from now and make a brand new ending.”

Carl Bard

This quote is the motivation behind this whole post. It’s the reason I think everybody should have financial goals right now, no matter their financial situation. Don’t wait until some mythical “later” point in time to get started on this stuff. “Later” will never, ever come. But if you start now, and set some goals, you have every opportunity from now until you die to revise those goals.

So how do you go about making sure you save for the right thing? Start by deciding what the right thing is for you, right now.

Step 1: Goals

It really should be this simple: make some goals. ANY goals. Make sure that they’re SMART goals and that the source of inspiration is you. Don’t worry – you’ll have plenty of time to adjust those goals as time goes on. Just get something down now.

If you’re not sure how many goals you should have, start with 2 or 3. Can’t decide which 3? Try prioritizing with an importance/difficulty matrix and go from there.

Step 2: Live Your Life!

No really, step away from the computer and go do the things that you want to (or need to) do with your time. Try to think less about what you should do with your money and more about what you want to do with your time.

Keep this up for about a month. Then, you’re allowed to go back to your goal list.

Step 3: Reevaluate Your Goals

Has it been about a month? Good. Now, take a little time to think about your life over the past month. Were you focused on what you wanted to be focused on? Did you spend your time on things you enjoyed? No?

Damn.

But in all reality, we probably spend a lot of our time on things that need to be done, rather than the things that you want to do. But did you get a sense of what you wanted to do over the past month? Hold that in your mind.

Now pull out those financial goals. How many of them are pointing you in the direction of what you want? How many aren’t? Can you shift your financial focus from your irrelevant goals to the ones more relevant to your dream life?

Here’s the thing: a lot of the time, we have financial obligations that we can’t shirk. Student loans are going to follow us until we actually pay them off. Insurance can’t be ignored. But you might be surprised what you don’t care about as much as you think.

Taking control of my finances and shifting them to push me toward the life that I want to live is how I reduced my clothing budget. I realized that, though I think fashion is fun and I admire well-outfitted folks….I’m not one of them. Clothing is not how I express myself. So why was I spending so much time and money trying to find new and trendy outfits??

Summary

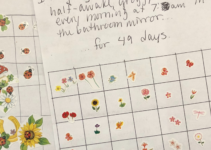

Knowing how to save for the right things is a highly personal process. But I think that, if you take some time to really pay attention to your life – and how you use your resources like time and money – you might find some spots where you can optimize your spending. Despite loving to knit and crochet, I haven’t bought new yarn since 2018. Turns out, having a big varied stash doesn’t fit my style – I shop in stores, not my shelves, when I have new projects in mind. So I’ve been working through my stash in that time.

All this to say: figure out what you want your life to look like, and then save for that life. And don’t be afraid to walk away from habits just because they’re part of your hobbies. Happy hunting!