Let’s talk a little bit about a specific budgeting method. I laid out a basic approach to budgeting in this post, but I’ve seen the term “envelope method” floating around. I’ve discussed how emotional money can be, so we already know that it’s hard to stay logical with your finances. But the envelope method is one way to make your money decisions at the beginning of the month, and therefore take some of the emotion out of it.

So…what is it?

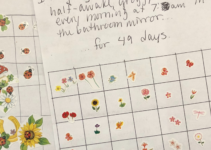

In its simplest form, you take a bunch of envelopes (one for every bill and expense category), and put the amount of money you will spend on each bill or category in the envelope at the beginning of the month. Then, when it’s time to pay the bill, you have the money physically set aside. And if it’s a variable expense like groceries, when the money is gone, it’s gone.

Now, in this day and age, using physical envelopes (and cash!) might seem a bit cumbersome. But I personally know at least one millennial who uses this method in its truest form, so don’t knock it ‘til you try it.

Another important tenant of the envelope method is to NEVER pull from other envelopes. Even if it’s the same “type” of expense – when you run out of restaurant funds, don’t pillage your clothing fund. Instead, get creative! Eat leftovers for the week or host a potluck for your friends. The idea of the envelope is to break the habit of reaching for your wallet without thinking about it first.

If you control your spending in a category for a month and you have money leftover, you can choose to either save it for the next month or pull the cash out and put it toward a longer-term savings goal, like an emergency fund or investments.

The envelope method in a digital world

There are a lot of digital solutions for the envelope method. The most popular one is probably You Need A Budget, a personal finance software program that directs you to assign your money to categories (their word for envelopes). I’ve been using YNAB since 2013 and I LOVE IT.

You could also use the envelope like a checkbook – when you spend money online from an envelope, pull that amount of cash out or make a note on the outside of the envelope so you know that you don’t have that much money available anymore.

That said, there is something powerful about using cash – when you spend physical bills, your brain gets more specific feedback on how much you’ve spent. Swiping the same card every time doesn’t have the same impact.

Envelope method vs. zero-based budgeting

Zero-based budgeting is also a very common personal finance method. With zero-based budgeting, you assign every dollar you have to a specific purpose. There are no lingering “slush funds” – you are aware of every dollar that you have, and you’ve decided what to do with it.

A person can use the envelope method to carry out zero-based budgeting. That’s how YNAB works, after all. But don’t get the two confused! You can use the envelope method to prepare for your expected bills, but not assign the rest of your money to a specific purpose.

Fun fact: stock photos involving money are my favorite.

Envelope method and Dave Ramsey

One of the most prominent proponents of the envelope method is financial radio show host and author Dave Ramsey. He wrote an immensely popular book, Total Money Makeover, that outlined his “seven steps to financial stability. (By the way, his seven steps aren’t so different from the ones I suggested in this post).

Summary

I hope I’ve helped clarify what the envelope method is. It’s pretty straightforward, but it’s important to understand that it’s not a silver bullet. Ultimately, to be in control of your finances, you have to find what works for you. If you haven’t tried it but want to get spending in a certain area under control, give it a shot for a month. Pay attention and see if your attitude toward that category of spending shifts in the month. You might be surprised what you find!

This is super interesting. We did the envelope method when the kids were young. We even had Zack and Ari doing it with savings and purchases. But since we’ve gone digital I find it much harder to do. So Thank you for the ideas.